Taxes (a Government Finance Issue)

The functions performed by our governments and the services and benefits they provide cost money. To pay for this government spending, our governments must raise revenue through some combination of taxes, tariffs, levies, duties, fees and fines that they impose on businesses and individuals. Eventually, one way or another and to varying degrees, this government revenue all comes out of our pockets.

Our sales, use, property, income and various other taxes add to the price of everything we buy. The government uses a good portion of this tax revenue to pay for protecting our economic system and the quality and safety of our goods and services. Without the protection provided by the government, businesses and individuals would need to spend a lot of money to provide for their own protection, which could cost us all a lot more than what we pay in taxes for this protection.

In addition, without the government’s product standards and inspections, the quality and safety of what we buy might be inferior to what we currently have. However, too many government regulations could end up making some things more expensive than they really need to be. Therefore, we need the proper types and amounts of regulations.

In the previous section, we have already talked about some of the things that the government spends money on and how we need to ensure that our governments are spending wisely. In this section, we will talk more about how we can ensure that our governments are taking in enough revenue to support the spending that we need them to do, and that we are each paying our fair share of the taxes and no more. We will also look at some new ways for our governments to finance their operations and the projects and programs that we need.

First off, most of us would probably not want to give up the benefits and services that we get from the government, but few of us really like paying taxes. There are several reasons for this.

For one thing, most of us like the idea of being able to get something for nothing or at least at a bargain price. Of course, if one person gets something for nothing or at a real bargain price, then someone else will end up having to pay for it.

One reason we do not like paying taxes is that we rarely see a direct connection between the amount we pay in taxes and the things that we get for our tax money. When we make our own purchases, we can see a much more direct correlation between what we spend and what we get, and we can more clearly see whether we got a good deal or not.

Without being able to see a direct relationship between what we and others pay in taxes and what we and they get back in return, it is difficult to determine whether we or others are paying our or their fair share or not. This leads to the issue where we might feel, rightly or not, that we are paying too much in taxes and that certain others are not paying their fair share.

In addition, we are constantly hearing about government waste and corruption, which can lead us to the conclusion that most of our tax money is being wasted or going into someone else’s pocket. We can hope that most of our money is being spent wisely, but we cannot be sure without some strict accounting of our government revenue and spending.

Another big issue with our tax system is that it is too heavily dependent on the strength of our economy. The government revenues that come from our income taxes, sales taxes, property taxes and many other types of economic activity and prosperity type taxes and fees are all dependent on the size of and the growth rate of our economy. On the other hand, a good portion of our government’s spending is inversely dependent on the strength of our economy. This means the government gets less revenue at the very time it needs more.

When the economy is doing well, the government’s revenues are up and the spending needed to provide for the needy is down, which should leave us with a surplus that can be saved for a rainy day. Of course, the extra revenue can be a big temptation for our representatives, who will often try to spend it on new projects or services or will try to reduce our taxes without concern for what revenues may be needed in the future.

On the other hand, when the economy is doing badly, revenues will be down and spending will need to go up to support the needy and to help stimulate the economy, which will cause the government to run a deficit. If the government has not saved for this rainy day, then it will have little power to help “fix” the economy. If the government tries to reduce the deficit by raising taxes or cutting services, it risks making the economy worse. If it spends too much money on stimulus packages, it can throw the economy out of balance and end up making the deficit even worse, which will end up costing us even more in the future.

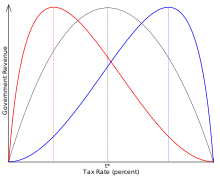

The Laffer Curve illustrates the concept that tax revenue will increase with an increase in the tax rate, up to some point, and then will decrease with further increases in the tax rate. It is obvious that a 0% tax rate will bring in no tax revenue. In addition, there will be no tax revenue if the tax rate gets too high, since it will raise the cost of goods and services to a point where they will cost too much for anyone to be able to afford to buy them. However, the concept states that at some undetermined intermediate tax rate, tax revenues will be at their highest. The diagram shows 3 possible Laffer Curves, where each might be valid for different types of taxes.

The Laffer Curve illustrates the concept that tax revenue will increase with an increase in the tax rate, up to some point, and then will decrease with further increases in the tax rate. It is obvious that a 0% tax rate will bring in no tax revenue. In addition, there will be no tax revenue if the tax rate gets too high, since it will raise the cost of goods and services to a point where they will cost too much for anyone to be able to afford to buy them. However, the concept states that at some undetermined intermediate tax rate, tax revenues will be at their highest. The diagram shows 3 possible Laffer Curves, where each might be valid for different types of taxes.

This concept parallels the concept of supply and demand that is used by businesses. A business needs to mark up the price of its goods and services by some percent beyond their fixed plus variable costs to make a profit, but not mark up the price so high that not enough of us will buy them. For a business, the goal would be to maximize profits, so they need to mark up the price by just the right amount. However, a business may also need to be concerned with their competition. This means they may need to keep their markup a little lower to beat the competition, which also means a little less profit.

The government also wants to maximize their tax revenue in order to provide the needed government services without running a deficit. Some politicians say that tax cuts will stimulate the economy, and that the increase in economic activity will bring in more than enough revenue to make up for the lost revenue from lower taxes. Other politicians say that higher tax rates are needed to bring in the revenue to pay for needed government spending.

In most cases, these politicians have no idea what tax rate would constitute the sweet spot where we will get the maximum tax revenue. If the tax rate is already below this sweet spot, then lowering it will lower tax revenues. If the tax rate is already above this sweet spot, then raising it will also lower tax revenues. Therefore, the key to maximizing tax revenue is to figure out where this tax rate sweet spot is and then, and only then, lower or raise the tax rate as needed to get to this sweet spot.

Although the concept behind the Laffer Curve points to a specific tax rate that will maximize tax revenues, there actually is a range of tax rates where revenues would only increase or decrease by a small amount. Therefore, the goal should be to find the lowest tax rate that will bring in the needed tax revenue. In this way, we can allow for maximum economic stimulation, without the need to run a deficit.

However, there is another point to keep in mind. Just because a given tax rate is best in one case does not mean it is best in other cases. Each case must be evaluated to see what the best tax rate is for that case. For example, the sales tax on one product may be best at one rate, but the sales tax on another product may be better at a different rate. In addition, the income tax for a low wage earner may be better at a lower rate than that for a high wage earner. As conditions change, the tax rates that would produce the maximum tax revenues may also change, which may then require a change in the tax rates.

The Laffer Curve also shows us that there is a maximum amount of tax revenue that the government can collect. This then sets an upper limit on the amount of money that the government has available to spend. If a government ends up spending more than the amount that it can possibly collect, then there will be a deficit that will require less future spending or will lead to bankruptcy.

When a government collects taxes, levies and fees, one of its most important goals must be to ensure that it brings in enough money to pay for the things that it needs to do in a way that is fair and equitable for everyone concerned. One of the best ways to do this is by directly getting the money in exchange for providing the specified service. For instance, the government could charge a toll for using a road to pay for building and maintaining that road.

When it is not possible to charge for a service directly, taxes should be imposed based on the probability or risk of needing a given service. This would be like the way some of us need to pay more for insurance based on the probability that we will need a payout. For instance, most of us hope we do not need to have the fire department to put out a fire or for the police to investigate a theft, but we need them to be available when the need arises. Just like insurance provides protection to all its policy holders, these government services need to be provided to all the government’s citizens.

Therefore, a system needs to be in place to collect taxes so that we all pay our fair share for these services. For instance, fire protection is most needed by property owners, so property taxes should include a component that charges higher taxes based on the probability that a property will have a fire and how much it would cost to put out that fire. In a similar fashion, those of us who earn more or who have more personal property may be at a greater risk of being robbed, so income taxes and personal property taxes could be used to help pay for police protection.

Another important tax goal for the government is to ensure that it can collect enough taxes, levies and fees to pay for what it needs to do no matter what the economic conditions are. One of the biggest shortfalls of many governments is that they only plan for how they will handle things in times of prosperity. When the economy turns bad, they do not have enough money coming in to maintain needed services and programs, which means they will start cutting them just when we may need them the most.

One thing that a government must always do, no matter how well the economy is doing, is to ensure it does not waste money. Along with this goal should always be the goal of saving for a rainy day, since something unexpected may come up, even in the best of times. If a government has saved enough, then it will be able to better ride out the bad economic times and be able to handle the most unexpected problems without reducing needed services and programs.

In bad economic times, the biggest tax revenue problem is that income tax revenues will be reduced when we lose our jobs, and sales tax revenues will be reduced when we cut back on spending. Therefore, a critical piece to the tax puzzle is for our governments to have a way to even out their revenue stream. Saving for a rainy day will help a lot, but some alternative means of providing services and beefing up tax revenues may also be needed.

When I talked about evening out employment in the section on jobs, I touched on one way to help the government maintain its service level. The government could reduce the hours of its regular employees and bring in the otherwise unemployed to help fill in the ranks at lower pay. This would allow government employees to at least keep their jobs and to also help the otherwise unemployed earn at least some minimum amount to keep them going, while reducing the government’s costs.

Tax revenues can also be helped by stimulating the local economic activity. We do that by putting the unemployed to work on special backup jobs, so that their labor would not be wasted. During times of full employment, these jobs might not have been worth doing because other work would have been more profitable. During times of high unemployment, the income from these jobs would earn the workers and the government enough to offset at least some of the costs that would have resulted from them being unemployed. For instance, we could make goods or provide services that would have normally been cheaper to import, but that would now make more economic sense to be done locally.

Theoretically, requiring our governments to have balanced budgets would be a good way to prevent deficits, but it would need to be done in the right way. If we just put spending limits on our governments and not let our governments borrow when needed, it would do little to ensure that our money is being spent wisely and could deprive us of needed services. Sometimes, we must borrow to invest in something that will bring us big returns in the future.

What we need to do is to require that each dollar of spending is backed by a dollar of tax revenue. If the costs would recur each year, then the government must show that there would be sufficient future revenue to continue funding the spending for as long as it was needed and not just for the first 5 or 10 years as is often done.

In some cases, current spending is needed to invest in some project that provides benefits in the future. A new road or building may be needed, or money may be needed to cover some unexpected expense. In these cases, it would need to be shown that there would be enough future revenue to pay back what was borrowed and to cover the interest on the loan. If the revenue needed to repay the loan comes directly from the benefits derived from the project, then that helps to show that the project had merit.

Of course, even if it can be shown that there is money to cover some spending, it does not mean that it would be the best use of that money. Our governments should first do the appropriate cost versus benefit analysis and prioritize our spending on everything to ensure that our money will be spent wisely.

As individuals, we must decide how we want to earn and to spend our money. This means making choices as to how much education and work we are willing to do to earn enough money to get the things that we need and want. For most of us, we will want more than we will be able to afford to get with what we will earn from the work that we are willing to do.

Therefore, we may need to prioritize our wants, so that we can spend what we earn on the things that are the most important to us. If possible, some of us might be able to work more, so that we can earn enough to get more of what we want. For most of us, we will need to limit our spending on the things we want based on our available time and money.

Of course, few of us will end up making the same choices and most of us will wish we had done at least a few things differently with our working and spending. Nevertheless, we will have been, for the most part, in charge of deciding which of our wants we ended up getting.

Through our national, state and local representatives, we also need to make many decisions about the role that our governments play in our lives. We must decide what our governments need to do, how much money they will need, and how much each of us should be taxed. The first step would be to decide what things we need and which of those things are best done by our governments, and which are best left up to us.

Then we must prioritize the things that our governments should do based on their importance. This prioritization should go down to the lowest levels. That is, each thing should have its parts prioritized and not just its whole. For instance, having a national military may be a very high priority thing, but having more types and larger quantities of some equipment may have a far lower priority than doing many non-military things.

For high priority items, there may be no choice as to whether we must raise the money and do them or not. For lower priority items, there will be a point where higher taxes will be too much of a burden on us to justify the expenditure. Of course, there may be times when some things are too important to wait until they can be paid for through current taxes. In these cases, the government may need to borrow money so that we can take care of them now and then repay the money from future tax collections. In these cases, we must be willing and able to give up some things in the future.

It is also important to decide which government should do what. The national government should only deal with national issues such as protecting the nation, dealing with foreign governments and relations between states, and handling things that need to be the same for everyone. State governments should only deal with issues that vary between different parts of the country, but which are pretty much the same within the state. Local governments should only deal with issues that vary between different parts of the state or that need more of a community or personal touch, which would not be possible to do at higher levels of government.

With few of us agreeing on what our governments should be doing and spending, and how much we should be taxed, it is no wonder that many of us are unhappy with our governments. The best course of action is to leave as many things as possible up to us or to private groups so that we have a better say in what our money is spent on.

In many cases, there are a lot of us who may want to do things differently than others. If what we want to do would not unduly harm others, then we should be allowed to handle these cases ourselves. For instance, many of us may want, and be willing to pay for, very different types and amounts of health care coverage, so it should be left up to us to make our own choices about our own health insurance.

Now, from the other side of the equation, we must decide how much money can be raised to pay for our government spending. This can be very difficult to determine. If taxes are too high, then our governments may raise enough money for their programs, but we could not keep enough money to do or to get the things we want or even the things we need. If taxes are too low, then we will keep more money, but our governments will not raise enough money to pay for all the important programs.

A balance must be found where our governments will be able to raise enough revenue to pay for the things that we need and that are best done by them, and we will keep enough money to spend on enough of our needs and wants. The bottom line is that we want to get the most we can for our money, whether it is spent by us or by our governments on our behalf.

The main jobs of our governments are to protect us and our property, and to provide certain needed services. If some of us need and use more protection and services than others, then it would make sense that we should pay more in taxes and fees. Those businesses and individuals who use up more of our national resources or pollute our environment should also pay more in taxes, fees and fines.

For instance, there should be a tax on power plants and factories that is based on the amount of pollution they put into our national air, water and land. Of course, not polluting is better, but when it is done, those that do it should pay to clean it up or compensate those of us who are harmed by it.

Given the high cost of cleaning up and compensating us for our losses, the pollution taxes would cost companies far more than the investment needed to reduce their plant’s pollution. The hope is that companies will want to do the right thing here on moral grounds, but the higher taxes, based solely on the harm being done, can also provide the right cost incentives, so that it also makes it the right thing to do financially.

The most important job performed by our governments is providing for our protection and the protection of our belongings and our wealth. Each level of government plays a different role in our protection and uses different methods for raising the revenue needed to pay for providing each type of protection.

The biggest differences can be seen between our national, and our state and local governments. The federal government must deal with protecting us from foreign threats and threats that cross state lines using diplomats, spies, the military, customs, federal police and various national regulatory agencies. The state, county and community governments must deal with protecting us from local threats using police and fire departments, inspectors and various local agencies.

The federal government relies mainly on personal and business income taxes, property (Ad Valorem) taxes, and fees to pay for providing protection. Many state and local governments also rely somewhat on income taxes and fees to pay for providing protection, but also often rely more heavily on sales and property taxes.

There are 3 main areas that need to be protected. These are our lives, our freedoms and our possessions. In addition, each of these can be considered personally and collectively. For instance, each of us may personally possess some money, clothing, and other personal or family possessions and property, and collectively our public buildings, national parks and other things that our governments are responsible for taking care of for the benefit of all their citizens.

The fairest means of paying for protection would be some way that would base it on need. When it comes to our personal protection and the protection of our collective national wealth, we each should be equally responsible. Those living in each state would be equally responsible for their collective state wealth. Similarly, residents would be equally responsible for their collective local wealth. When it comes to our personal possessions, we each should be responsible for paying for the protection of what we each have. Therefore, we need at least two very different types of taxes.

In the first case, each of our lives should theoretically be of equal value, and we should share equally in what we as citizens collectively own. Therefore, each citizen should shoulder equal responsibility for paying our governments for our protection and the protection of our shared possessions. This could be handled through some types of national, state and local citizenship taxes, but this can be tricky to do when many of us are out of work or just making enough to get by. However, there is a way to handle this fairly.

In the second case, the more we have, the more we could lose from theft, fire and other means. Therefore, our governments will need to spend more to provide the additional needed protection to those of us who have more and should therefore impose taxes that are commensurate with our personal wealth. This could reasonably be done with a combination of Income, Sales, Property and Resource Use taxes.

The idea of a citizenship tax can be found rooted in the concept of every citizen supporting and coming to the aid of his or her community. For a community to succeed, its citizens need to come together during good times and bad times to build or to protect the community. In the past, this might have involved helping at a barn raising or taking up arms against bandits or invaders as part of a local militia. Today, it might be helping with a school fundraiser, or being involved in a block watch program.

In a small community, most of us know one another, and it may be easy for us to know who has been helping and/or protecting the community and their fellow citizens, and who has been trying to get a free ride. In larger communities, there are far too many of us and far too many ways in which we could be helping, which makes it hard for us to know who is doing their part. Therefore, it is important to handle some of this in a more formal manner where we impose a tax or work requirement and keep track of who has paid their tax or met their requirement.

To start with, we would contribute in ways in which we are best able to do our part. We need to realize that someone flipping burgers for a living may not be able to contribute in the same way as the CEO of a big company. To be fair, we need to base this citizenship tax on what each of us can contribute to the community, but not make it a type of income tax.

Even if we do not make or have as much money as someone else, we all do have the same 24 hours in a normal day. Therefore, we can base each our citizenship taxes on the wages we could make for the number of hours that we would be required to contribute to the community. We could then pay this tax with money or by working that number of hours for the community or via some combination of money and work.

Therefore, to come up with the appropriate citizenship tax, we would first determine how much it would cost to provide the needed protection for our lives, our freedoms, and our shared wealth. We would then convert this cost into the number of hours each of us would need to work, by dividing the total cost by the appropriate average hourly wage for our given community. Finally, we would multiply these citizenship tax hours by the appropriate hourly rate for each of us to get our citizenship tax amounts.

Of course, it is important to come up with the right hourly rate for each of us. This hourly rate needs to be based on what each of us has shown we are capable of or the skills we have. Someone who has only worked at minimum wage jobs and does not have any marketable skills would probably pay a tax equal to some minimum wage times the hours for the citizenship tax. A CEO, doctor, lawyer or other high paid professional or someone who has those skills but may not be currently working would pay based on an appropriate hourly rate for their profession or skill set. We must also make an appropriate offset to this hourly rate to account for time that an individual needed to spend in school to learn their profession.

As I have already mentioned, we would have the option to do actual work for the community for the number of hours on which our citizenship tax is based. This would be a very important option for those of us who may be short of funds due to being unemployed or underemployed, or for those of us who simply prefer getting involved in the community or who what to spend our money on other things.

At times, there may also be a need to impose an additional citizenship tax over and above what would normally be imposed. For instance, there could be a flood, an earthquake, a forest fire, or some other disaster that needs the community to come together to help and to rebuild. There also may be instances where the community wants to create a park, build a new community center, or do something else where the community can come together to make everyone’s life better. Again, some of us may prefer paying this tax with money and others with their time.

There should also be some appropriate credit given towards paying this citizenship tax for those of us working in certain government professions that are dedicated towards helping protect the community like military, police, fire and rescue personnel.

We currently have various income, sales, property, and resource use taxes imposed at various levels of government. For the most part, there has been no effort to tie each of these taxes to any specific needed government spending needs. Without some analysis to determine how much of each tax should be imposed based on what each generates in needed government spending, there is no way to know whether any of these taxes are too high or too low.

Given the wide range of different types of income, products, services, property, and resources, it will take a lot of work to come up with the right mix of taxes. Given that, one might wish for a simpler way to tax these things. One idea might be to eliminate one or more of these tax types and rely on the others to cover everything or to replace everything with a new wealth tax.

The problem with trying to simplify things in this manner is that it would probably be impossible to come up with anything that would be fair for all of us. Therefore, we need to do the work to come up with all the various tax types and rates that will best generate the tax revenues needed to support the various government activities needed to protect us.

The best way to handle these taxes is to look at how much it costs the government to protect our different types of income, sales, property, and resources, and then come up with an appropriate tax rate for each. Where appropriate, we should simplify the tax rates, minimize the number of different types of taxes on the same things, and consolidate the taxes across various levels of government.

We also may need to add more types of taxes, fees and levies to pay for things that are currently being paid for by the revenue from taxes, fees, and levies that are unrelated to the things that they are paying for.

I will now talk about most of these tax types and a few new ones here in this section. Since the topic of income taxes is so complex, I will save that for its own section coming up next.

Goods and services require material, energy, and labor resources. Since the world’s available resources are limited, there may not be enough resources available to supply all our needs. To protect our access to needed resources, we need to try to reduce our need for them and to try to eliminate, or at least reduce, our waste of them. To do that, we need to track and to manage our resources effectively. To pay for this, we could use a variety of sales taxes and some specific resource use taxes.

The basic idea of sales or resource use taxes on energy, goods and services may seem to be as simple as putting an appropriate tax rate on them, but this can get complicated. A single rate on everything would not fairly reflect the costs of protecting each one. On the other hand, if we set different tax rates for each one, it could get very complicated. Instead, we need to find a way to keep the sales and resource use tax rates simple, but also ensure each resource is appropriately taxed.

What we need to do is handle these taxes differently. We should use the sales taxes to pay for protecting commerce and use resource use taxes to pay for protecting our resources. This way, the sales tax rates could be consistent across most things, while the resource use tax rates could vary according to how much each type of resource needed to be protected and how much the use of each type of resource could damage our environment and our health.

Currently, the implementation of sales taxes in the United States is quite complicated. Not only does the tax rate vary from state to state, but in many cases, it can vary by county, city, or town, or by different products or services.

There is also the problem where the tax is both the responsibility of the seller and the buyer, who could each be in a different state. For instance, if the sellers are in states with a low sales tax or no sales tax and the buyers are in high sales tax states, the buyers may be responsible for paying the difference in sales tax to their state.

This situation can cause two different problems. In one case, the buyer will need to take the responsibility for determining how much they owe on an out-of-state purchase and make the appropriate payment to their state. In the other case, the buyer purposefully or through ignorance of the law does not pay the tax amount owed and the state loses out on this tax revenue.

A choice must be made as to whether the sales tax is based on the location of the seller or the buyer. In either case, things can get complicated. If it is based on buyer’s location, then every seller must determine the home jurisdiction of the buyer and remit the appropriate tax amount to that jurisdiction. If it is based on the seller’s location, then merchants in high sales tax states could lose sales to low sales tax states.

To decide who pays the tax and which government gets the tax revenue, we must first look at what government services and programs the tax is paying for. Since the Treasury Department is responsible for providing and protecting our money supply, any monetary transaction should help pay for its services. In addition, the Commerce Department must protect our commerce, which would include the sales of goods and services, so that department should also get a share of the sales taxes. Both departments are at the federal level, so we should have a national sales tax that would apply to any sales in the United States.

Additional sales taxes may also be needed at the state and local level. Each would need to be based on what services and programs are being provided for which a sales tax makes the most sense to pay for them. For instance, the state or local jurisdiction would need to inspect and to provide protection for the businesses selling goods and services. These jurisdictions could then impose appropriate sales taxes to help pay for this. Therefore, these sales taxes would be best paid based on point of sale. If the buyer takes possession at a different location, then we may want to split the sales tax between the two locations.

When we buy merchandise that will last more than a few days, it will need to be protected. However, unless this merchandise has a high value it may not be worth the effort or expense to try to identify these other jurisdiction sales to impose a sales tax on it. Therefore, the best way to pay for that protection would be through some kind of property tax. However, trying to track or to inventory this property may not be worth the effort or expense of imposing a property tax.

In most cases, the seller and buyer would probably be in the same jurisdiction, and we can expect that individuals from different jurisdictions may be about as equally likely to buy in other jurisdictions. Therefore, sales in each jurisdiction should be about the same as if everyone had simply bought locally. Therefore, using some of the sales tax collected at the point of sale or at the location the buyer took possession to pay for protecting what is bought should be fine.

For higher value merchandise, more protection may be needed, since these are the things that most thieves would target. Although we would have paid a higher sales tax amount on this higher value merchandise, it may not be enough to cover the higher cost of protecting it. In some cases, the buyer’s jurisdiction will have a second chance to tax this higher value merchandise. For instance, a car needs to be registered, so we can have a registration tax. Some merchandise may need to be delivered, so we can have a delivery tax. Other merchandise may need to be insured, so we can have an insurance tax or property tax.

Therefore, the best course of action would be to always base the sales tax on a combination of the point of sale and the location where the buyer takes possession of the goods. This keeps things simple and in most cases is the most logical and fairest thing to do. When we buy and take possession of merchandise in a store, we would pay the local sales tax. When we have something delivered from a store, a catalog, or a website, we would pay a sales tax that would have a component for where the merchandise is sold from and where it was delivered to.

Given that we could have a national sales tax, and state and local sales taxes for both the sale location and the delivery location, we need to have a central location for our sales taxes. Therefore, the Federal government would keep a database with all the sales tax rates for all locations for both the sale location and the delivery location. All sellers would be able to access this database to get the appropriate sales tax rate for each sale. By going through the Federal government, sellers would just need to have one Federal Sales Tax Identification Number.

To further simplify things, the Federal government would collect all the sales taxes. When sellers sell something, they would link to the service that would provide them with the correct sales tax rates for the seller and buyer locations and would send the sales tax amount to the Federal government. The Federal government would then take their sales tax amount and distribute the remaining sales tax amounts to the appropriate state and local governments.

There is one case where having a sales tax based on where someone lives would be helpful even when we buy and take possession of merchandise in a store. That is, we could have a reduced sales tax rate for when the merchandise sold was manufactured locally and the buyer lived locally. This would encourage us to buy locally made goods, which would help the local economy.

The sales tax problem has been even more complicated for internet sales. In some states, internet sales are not taxed unless the seller has an actual physical location like a store or warehouse in the buyer’s state. Therefore, sellers do not need to collect these sales taxes and the buyers may need to report their purchases and pay their own sales taxes. In these cases, a buyer may forget to pay the sales tax or may simply not pay it.

In other cases, sellers need to determine which states they need to collect a sales tax for and be registered with that state to be authorized to collect those sales taxes. Then, they need to determine where buyers are from and apply the correct sales tax rate. Of course, some counties, cities and towns also have their own sales taxes, which can make things even more complicated.

As with sales from stores, the best thing to do is to have the internet sellers register with the federal government to collect sales taxes. They would also use the sales tax rates kept in the Federal sales tax database for the sale location and the delivery location.

If a seller was in another country and wanted to sell their merchandise in the United States via the internet, we have two options. We could have the foreign company register for a Federal Sales Tax ID and then collect and send in the taxes, or we could collect the taxes from the buyer when the goods reach the United States. Either way, the buyer would be required to include some appropriate additional information on the package. This may be in the form of a bar code that would include the sale amount and any sales taxes paid.

If the seller had collected the taxes, the information would include some confirmation number showing that the sales taxes had been sent in. If the company had not collected the taxes, the information would include the sales price and any other information needed to collect the taxes from the buyer.

Given the extra work needed to process merchandise bought in foreign countries, we should include an appropriate foreign sales tax on this merchandise. To pay for the extra verification or tax collection step, we should impose an appropriate fee on these goods to cover these additional costs.

We currently have various property taxes. These are generally imposed at the state and local level and are based on the estimated value of the property. For real estate, the value is usually based on the current market value. For cars, trucks. boats, planes, and other vehicles, it would be based on the depreciated value of the vehicle.

Our governments need to help protect our property, so some of these taxes should go towards those government services that help to protect us and our property, like fire, police, and military. Given that we need the military to help protect our property, then the Federal government should also impose appropriate taxes on our properties.

One big problem with real estate taxes is the subjective value placed on the real estate, and the burden imposed on homeowners when their property values and corresponding taxes dramatically rise. When taxes rise too dramatically, we can be forced out of our homes when we are unable to pay the higher real estate taxes. There needs to be a way where we can both remove the subjective nature of real estate taxes and prevent too much volatility.

As I talked about in the section on our environment, we can shift the way we determine our real estate taxes away from its presumed value and more towards its land use. That is, the main portion of our real estate taxes should be based on land use and the amount covered by buildings, driveways, and other things.

Our real estate taxes would be higher on land that was covered in buildings, driveways, walkways, patios, swimming pools, etc., than on open land, and even less on land that had trees and other plants. Land use does not change much from year to year, unless someone adds or removes something, so our property taxes should stay relatively constant.

Another component of the real estate tax should be based on the condition of the land and the buildings. That is, we would have lower taxes on well-maintained property, and higher taxes on poorly maintained property. Not only are run down properties a danger to fire and police, but would also lower property values in the area, and could lead to crime and the deterioration of the whole neighborhood. Therefore, we want these taxes to discourage property owners from letting their property deteriorate.

Although we do tax some property, we do not tax all property. For lower value items, it would be far too complicated and expensive to try to put values on and to tax them. However, it is a different story with high value items. For instance, one type of high value property that we currently do not have a property tax for is investments. This would include stocks, bonds, gold, art, collectibles, etc.

These investments and other high value properties need to be protected, and various government agencies help with that protection and should be getting appropriate tax revenues from the owners of these properties to do that. This wealth tax would be on all investments and other high value property in the United States, whether the owner was a citizen, a foreigner, or a business.

The wealth tax rate on these investments and other high value properties would need to be quite low on a yearly basis. If the wealth tax rate were too high, then we would not find it worthwhile to invest. As with Income Tax, we should exclude some low value investments since it would not be worth the extra effort to tax them. Even with a low tax rate, a wealth tax could still bring in large amounts of tax revenue given the vast amounts of investments and other high value properties in the United States.

Determining the values of investments can be difficult since their values can sometimes fluctuate greatly. For instance, a stock price can fall dramatically in bad economic times and can rise dramatically in good economic times. However, a simple method could be used based on the average value of the property. When the property is sold, appropriate adjustments could be made based on what should have been paid in taxes if the property value had increased or decreased steadily over time. Then an appropriate refund could be made, or an additional tax amount could be collected.

For some investments like stocks, bonds, and gold, we can see the price changes each year and can therefore make any appropriate adjustments each year. The values of many collectibles are also tracked by collectors so we could also use those values to make any appropriate adjustments each year. Other values may change based on inflation. The bottom line is that when we can make appropriate adjustments in investment values, we should do so to collect the appropriate wealth taxes.

To be able to apply a wealth tax, we need to know what property each of us owns. What we need is a federal database that shows who owns what. There would be a record for each investment or high value property. We would need to decide what types of properties and values would be included. When the property is sold, the records would be updated to show who now owns the property and what price was paid for it. Not only would these records help with collecting the wealth tax but would also allow us to be able to confirm who owns what property.

For some property like homes, cars, and stocks, we already have records that show us who owns them. However, these records are at the local, state, and corporate levels. We also need these to be to be included in the federal database so that we will have one place where all property records are stored.

Most resources are limited, so we need to use them wisely and not waste them. This is especially important for those resources that we need to survive. The most obvious of these would be air (oxygen) and water. Without oxygen to breathe, we would be dead within minutes. Without water, we would be dead within days.

Most of us have experienced water shortages. There are few places where fresh water is not scarce on occasion or all the time. Therefore, we need to manage our water resources so that we all have an adequate supply. We can do this by storing reserve supplies in case of drought or higher than normal demand, and by limiting the number of individuals and businesses in an area to what should not strain the supply. We would pay for this via a water use tax that would be proportional to the cost of protecting the water supply in the given region.

We also want to make this water use tax vary based on its usage. Those individuals and businesses that use more than their fair share should be charged increasingly higher rates based on how much extra water they use. This will provide an added incentive for us to conserve and not to waste water, and to create an incentive to limit the local population to a level where there is an adequate supply of fresh water for all of us.

We may not consider air to be a limited resource, since it always seems to surround us, but in many places, clean air and clean water are often in short supply. First off, we want to limit the pollution from individuals or businesses to some reasonable amount. However, some pollution may be unavoidable no matter what we do.

Therefore, we need to tax those things that pollute our air and water supplies so that we will have the money needed to cover the higher health costs and the cost of the damage to our environment that will result from this pollution. In addition, we should incrementally tax each higher pollution level at higher rates. This will then really hit the worst polluters the hardest, and really encourage them to reduce their pollution rates.

In some cases, resources are non-renewable. This means that once the resource is gone, it is gone, and future generations will not have access to it. The best example of a non-renewable resource is oil. At the current rate, it could be gone in a matter of decades. As supplies are used up, costs will rise, which will encourage us to look for lower cost alternatives. The problem is that if we wait for rising costs to encourage the needed changes, we will go through an extended period of unnecessary turmoil.

A better alternative would be to start increasing the tax rate now so that we will have more incentive and money to invest in alternative energy sources now and to help pay for the higher health care costs caused by the pollution that comes from burning oil. This will give us more time to do things right and eliminate much of the pain that would have resulted from energy shortages.

Along with the resources above, we need to look at each of our additional resources and determine what the costs will be to protect them and what the appropriate tax rates will need to be imposed to bring in the needed revenue.

When goods are bought or sold outside of the United States, other than via foreign internet sales, we still have a problem. First off, we do not have any real control over what is taxed in other countries. Second, we cannot make sellers in other countries collect our sales taxes. The only thing we can do is to tax the buyers and sellers in this country appropriately. We could collect the taxes from the buyers when the goods enter the country, and from the sellers when the goods leave the country.

In general, we want buyers in other countries to buy our exports, so we do not want to make them too expensive. Therefore, we generally want to keep any export sales tax low, but they should be high enough to cover what those sales cost our governments. The exception would be when someone is exporting some valuable resource that would be hard to replace. For instance, we would want to collect extra sales taxes on any national treasure or anything that we would normally import, like oil.

On the other hand, we want to impose appropriate import sales taxes to cover the cost of inspecting the imported goods, and to cover the cost of our money going to other countries. Therefore, we should always collect a sales tax on imported goods.

In this case, most of this import sales tax would probably go to the Federal government and the rest to the buyer's local jurisdictions. In addition, this would help to raise the cost of imported goods to be more in line with the cost of goods produced and sold in the United States. This would then encourage us to buy more locally produced goods and help to keep our workers employed and more of our wealth here.

When goods are imported to the United States, there is the possibility that some form of contraband, counterfeit, pirated or dangerous goods or material are being smuggled in. Currently, we are only thoroughly inspecting a small portion of the imports to the United States, since inspecting everything would be a very expensive job.

To catch these illegal or dangerous goods, we need to inspect everything that is imported. To afford those inspections, we need to have the individuals and businesses who are importing the goods to pay for them. Not only would this help to pay for securing our borders and for keeping out a lot of contraband, counterfeit, pirated and dangerous goods, but the higher cost of importing goods could help to shift more production work back to the United States.

We would have a choice as to where we buy our goods. If paying the import inspection fees would cost us too much, then we would usually have the option to buy goods that are produced in the United States. Even if we cannot get the goods here, then we must realize that importing these goods will simply cost more and that we will need to plan accordingly. Of course, we also have the option of trying to get some business to manufacture these goods here.

Goods made outside of the United States may not have been manufactured in a way that complies with our pollution, safety, labor and other regulatory rules and laws. This can make these foreign goods cheaper to manufacture. This can put local manufacturers, who must comply with our laws, at a big and unfair competitive disadvantage. In addition, when we buy goods from foreign manufacturers who do not comply with our laws, we could end up encouraging pollution and unsafe working conditions in these other countries.

Although we cannot force foreign manufacturers to comply with our laws, we can impose restrictions or fees on goods imported to the United States. Without banning the import of any of these goods, the simplest thing to do would be to impose an appropriate import non-compliance tax on the importer for each law that the foreign manufacturer did not comply with. For instance, if a foreign manufacturer did not meet our pollution control standards, we would impose an appropriate fee on each imported item for the excess pollution.

If an importer could not show any proof of compliance, then the maximum fees would be imposed on each imported item. If an importer could show proof that the imported goods were manufactured in compliance with all our laws, then no fee would be imposed. The best way for an importer to show proof of compliance would be to pay our government to inspect the foreign manufacturer. Once a foreign manufacturer has been inspected, other importers could use the same proof of compliance report. Of course, periodic inspections would be needed to show proof of continued compliance.

Income Taxes -

Making paying our income taxes simplier and fairer.

|